In our last post, we talked about cleaning up your books and if you should do this yourself while providing some tips and tricks to get started on your own. In this post, we want to touch base on when to consider hiring a professional and items that you should not take on yourself!

If your company is like most businesses, at start up, you likely put together your financials haphazardly, using a template you found online to label revenue and expense items and report your profitability for tax purposes. This approach, while well intended, often leads to books and records that are not organized to help you evaluate key performance metrics, making it difficult to make informed decisions about your business as you grow. Whether your books are a total mess or were never really set up properly, there are steps you can take to correct these mistakes and get back on track. While some of these steps are straight forward and can be done on your own, others are better left to a professional. Let’s focus on the things you should not do yourself.

Your income statement should be divided into three parts; revenue, cost of goods sold, and selling general and administrative expenses. Often what we see is that revenue, cost of goods, and expense items all make it into the system, but they are not organized in a way that allows you to adequately evaluate your company’s financial performance.

What you need is to organize revenue, cost of goods, and expenses to help you assess your company’s key performance indicators. If your business is just getting started, you can use this great chart of accounts as a guide. However, if you’ve been in business for years, we strongly encourage you to seek out professional help, as updating or improving your chart of accounts involves a lot of moving parts, some of which require a strong understanding of accounting principles to get right and avoid messing up prior tax returns.

Not only will you need help updating the current period, but you’ll want to ensure historical periods follow the same infrastructure, so that you don’t lose the historical reference. Be mindful that this involves much more than simply inactivating or deleting transactions. You’ll need help moving and renaming accounts to help you preserve the integrity of your historical period. Mistakes are often uncovered during this process and depending on materiality, may require you to refile a previous year’s tax returns. A professional can help you determine materiality and how to handle a refiling.

Achieving this on your own is often too advanced (not to mention time consuming) for business owners, especially if you have years of financial data to correct. But, understanding what you are trying to achieve in categorizing revenue, cost of goods and expenses is still important. Thus, we will discuss each briefly below to you help you understand what professional cleanup seeks to achieve.

- Revenue

Let’s start with revenue. Many companies combine all of their revenue into one bucket. It’s all the same, right? Wrong. Not all revenue is created equal!

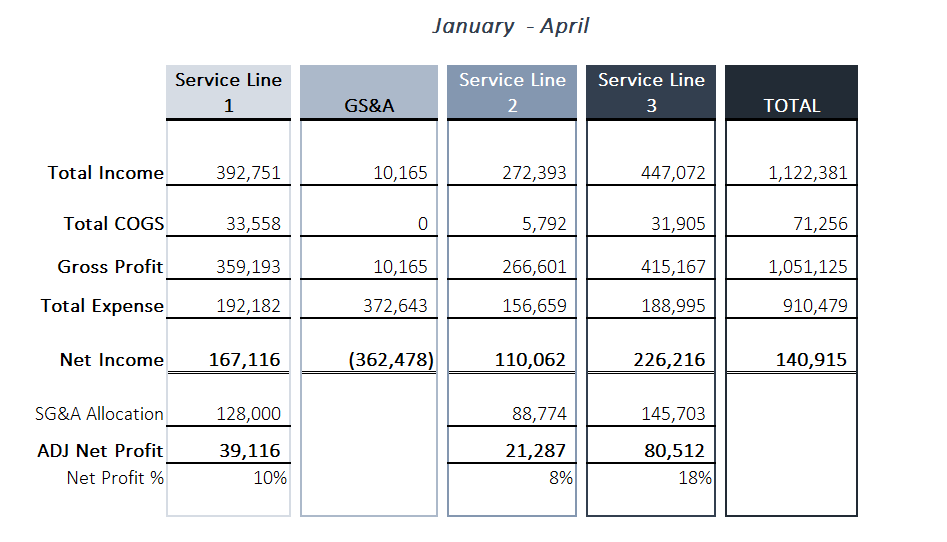

First, think about your business. How many distinct business lines do you have? If you run a manufacturing company, how many product lines do you make? For a consulting business, do you have different consulting services that you offer? If you can identify more than one way to categorize your business offering, your revenue should also be categorized this way. {1} The key is finding the right balance between gathering enough information to give you the insight needed while not providing too much detail. Essentially, you should focus on large revenue buckets of your major revenue streams. By creating revenue categories, you will be able to see where your revenue comes from and which business line generates the most. Plus, once we get into evaluating cost of goods and expenses, it’ll become even clearer why separating it matters. Hint: you’ll see which business line generates your highest margins.

- Cost of Goods Sold (or Cost of Sales)

Categorizing cost of goods sold involves a more thoughtful process and may require you to reverse engineer categories to help you capture what you need to help you make decisions. It should begin with identifying all direct costs incurred in delivering each product or service{2} and applying “class” labels that correspond to the appropriate revenue category. The following is an example class report that’ll show you how you can categorize your cost of goods and expenses to allow you to run reports that separate each business line and evaluate them on their own.

When you classify your cost of goods into categories, it then becomes possible to evaluate which business line generates the highest gross margin. In other words, you get to see which business line makes you the most money after direct costs are paid. Then you’ll gain insight into how your company makes money and how you might change or improve your sales strategy. Furthermore, you’ll see how much you have left to cover overhead expenses.

- Selling, General & Administrative Expenses (SG&A)

SG&A expenses make up your company’s entire overhead. Here, you’ll need to create big expense buckets with sub accounts to help you organize everything in to similar and relevant categories. By organizing this section of your income statement, you will gain insight into your company’s spending habits. Not only will it help you to see what your biggest expense items are, but it’ll help guide you in making critical business decisions.

For example, if your margins are not as healthy as you want them to be, you will be able to find out exactly where you are overspending. Let’s say your general office overhead (which includes items like office supplies, cell phone charges, utilities, meals, etc.) is much higher this year than last. If you haven’t organized your expenses, you’ll probably know that your overall spending has been too high, but there is almost no way for you to figure out the underlying reasons. With organized financials, you will not only be able to see that your general office overhead was up, but that you spent ten times as much on meals this year than last. Maybe you’ll recognize you’ve been doing this as a perk to keep your employees happy or perhaps you’ll learn that your business partner’s new corporate card is being taken advantage of. Either way, you’ll be empowered by the information needed to make a decision about how to handle it.

Conclusion

Your financial statements are a tool that can be used to help you make better, more informed business decisions. But informed decisions cannot be made if your books are a mess. While some clean up may be easy to tackle on your own, it may be better to hire a professional to help you deal with the underlying structure and organization of your books. Because not all bookkeepers have a strong understanding of accounting principles, you’ll need to make sure you hire a financial consultant that is. We find that basic bookkeepers are most successful when your books are already set up properly and are given some basic training on how to manage them going forward. Because the structure of your financial statements is so integrated, unaddressed problems have a snowball effect. Waiting too long to fix them will cost you dearly in the long run.

If you need help fixing your books or would like to discuss how you might improve your financial reporting process, we would love to help. Gemsbok’s professionals have over 15 years of experience developing and reporting on key financial metrics and have helped hundreds of firms grow and improve their business. Give us a call at 303.249.4687 or email Christina at christina@gemsbokconsulting.com to set up a time to discuss your business and its goals.

Christina Griggs is a financial expert and spreadsheet maven that has spent her entire life in and around the business world. Christina has worked as a short-interest trader in London, as an investment advisor with Dean Witter (now JP Morgan), as CFO for a corporate housing firm and CFO for an eCommerce marketing agency. This experience, along with her client work at Gemsbok allows her to continue to cultivate her enthusiasm for financial analysis. Visit our website or contact us for more information on our firm and services.

[1] If your company incurs travel or other expenses that are reimbursed by your clients, make sure to make a separate revenue category for this reimbursement as well.

[2] Remember that if you are a service business and employ professionals to help you deliver your company’s services, your people’s fully-loaded salary costs (including benefits, payroll taxes etc.) are likely your main cost of sales.